Brownian Motion & Stochastic Calculus

Continuous time financial models will often use Brownian motion to model the trajectory of asset prices. One can typically open the finance section of a newspaper and see a time series plot of an asset's price history, and it might be possible that the daily movements of the asset resemble a random walk or a path taken by a Brownian motion. Such a connection between asset prices and Brownian motion was central to the formulas of [1] and [2], and have since led to a variety of models for pricing and hedging. The study of Brownian motion can be intense, but the main ideas are a simple definition and the application of Itö's lemma. For further reading, see [3][4].

Definition and Properties of Brownian Motion

On the time interval [math][0,T][/math], Brownian motion is a continuous stochastic process [math](W_t)_{t\leq T}[/math] such that

- [math]W_0 = 0[/math],

- Independent Increments: for [math]0\leq s' \lt t'\leq s \lt t\leq T[/math], [math]W_t-W_s[/math] is independent of [math]W_{t'}-W_{s'}[/math],

- Conditionally Gaussian: [math]W_t-W_s\sim\mathcal N(0,t-s)[/math], i.e. is normal with mean zero and variance [math]t-s[/math].

There is a vast study of Brownian motion. We will instead use Brownian motion rather simply; the only other fact that is somewhat important is that Brownian motion is nowhere differentiable, that is

although sometimes people write [math]\dot W_t[/math] to denote a white noise process. It should also be pointed out that [math]W_t[/math] is a martingale,

Simulation. There are any number of ways to simulate Brownian motion, but to understand why Brownian motion can be treated like a ‘random walk’, consider the process,

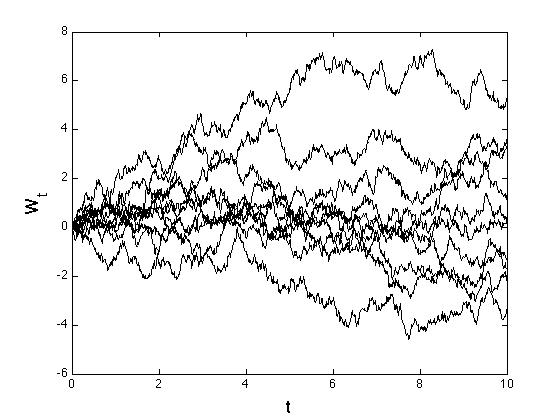

with [math]W_{t_0} = 0[/math] and [math]t_n = n\frac TN[/math] for [math]n=0,1,2\dots,N[/math]. Obviously [math]W_{t_n}^N[/math] has independent increments, and conditionally has the same mean and variance as Brownian motion. However it's not conditional Gaussian. However, as [math]N\rightarrow \infty[/math] the probability law of [math]W_{t_n}^N[/math] converges to the probability law of Brownian motion, so this simple random walk is actually a good way to simulate Brownian motion if you take [math]N[/math] large. However, one usually has a random number generator that can produce [math]W_{t_n}^N[/math] that also has conditionally Gaussian increments, and so it probably better to simulate Brownian motion this way. A sample of 10 independent Brownian Motions simulations are shown in Figure.

The Itö Integral

Introductory calculus courses teach differentiation first and integration second, which makes sense because differentiation is generally a methodical procedure (e.g., you use the chain rule) whereas finding an anti-derivative requires all kinds of change-of-variables, trig-substitutions, and guess-work. The Itö calculus is derived and taught in the reverse order: first we need to understand the definition of an Itö (stochastic) integral, and then we can understand what it means for a stochastic process to have a differential. The construction of the Itö integral begins with a backward Riemann sum. For some function [math]f:[0,T]\rightarrow \mathbb R[/math] (possibly random), non-anticipative of [math]W[/math], the Itö integral is defined as

where [math]t_n = n\frac TN[/math], with the limit holding in the strong sense. If [math]\mathbb E\int_0^Tf^2(t)dt \lt \infty[/math], then through an application of Fubini's theorem, it can be shown that equation \eqref{eq:itoInt} is a martingale,

Another important property of the stochastic integral is the Itö Isometry,

For any functions [math]f,g[/math] (possibly random), non-anticipative of [math]W[/math], with [math]\mathbb E\int_0^Tf^2(t)dt \lt \infty[/math] and [math]\mathbb E\int_0^Tg^2(t)dt \lt \infty[/math], then

Some facts about the Itö integral:

- One can look at Equation \eqref{eq:itoInt} and think about the stochastic integral as a sum of independent normal random variables with mean zero and variance [math]T/N[/math],

[[math]]\sum_{n=0}^{N-1} f(t_n)(W_{t_{n+1}}-W_{t_n})\sim \mathcal N\left( 0 ~,\frac TN\sum f^2(t_n)\right)\ .[[/math]]Therefore, one might suspect that [math]\int_0^Tf(t)dW_t[/math] is normal distributed.

- In fact, the Itö integral is normally distributed when [math]f[/math] is a non-stochastic function, and its variance is given by te Itö isometry,

[[math]]\int_0^Tf(t)dW_t\sim \mathcal N\left(0~,\int_0^Tf^2(t)dt\right)\ .[[/math]]

- The Itö integral is also defined for functions of another random variable. For instance, [math]f:\mathbb R\rightarrow \mathbb R[/math] and another random variable [math]X_t[/math], the Itö integral is,

[[math]]\int_0^Tf(X_t)dW_t =\lim_{N\rightarrow\infty}\sum_{n=0}^{N-1}f(X_{t_n})(W_{t_{n+1}}-W_{t_n})\ .[[/math]]The Itö isometry for this integral is,[[math]]\mathbb E\left(\int_0^Tf(X_t)dW_t\right)^2 = \int_0^T\mathbb Ef^2(X_t)dt\ ,[[/math]]provided that [math]X[/math] is non-anticipative of [math]W[/math].

Stochastic Differential Equations & Itö's Lemma

With the stochastic integral defined, we can now start talking about differentials. In applications the stochastic differential is how we think about random process that evolve over time. For instance, the return on a portfolio or the evolution of a bond yield. The idea is not that various physical phenomena are Brownian motion, but that they are driven by a Brownian motion. Instead of a differential equation, the integrands in Itö integrals satisfy stochastic differential equations (SDEs). For instance,

Essentially, the formulation of an SDE tells us the Itö integral representation. For instance,

Hence, any SDE that has no [math]dt[/math]-terms is a martingale. For instance, if [math]dS_t = rS_tdt+\sigma S_tdW_t[/math], then [math]F_t=e^{-rt}S_t[/math] satisfies the SDE [math]dF_t = \sigma F_tdW_t[/math] and is therefore a martingale. On any given day, mathematicians, physicists, and practitioners may or may not recall the conditions on functions [math]a[/math] and [math]b[/math] that provide a sound mathematical framework, but the safest thing to do is to work with coefficients that are known to provide existence and uniqueness of solutions to the SDE (see page 68 of [4]).

For [math]0 \lt T \lt \infty[/math], let [math]t\in[0,T][/math] and consider the SDE

From the statement of Theorem it should be clear that these are not necessary conditions. For instance, the widely used square-root process

does not satisfy linear growth or Lipschitz continuity for [math]x[/math] near zero, but there does exist a unique solution if [math]\gamma^2\leq 2\bar X\kappa[/math]. In general, existence of solutions for SDEs not covered by Theorem needs to be evaluated on a case-by-case basis. The rule of thumb is to stay within the bounds of the theorem, and only work with SDEs outside if you are certain that the solution exists (and is unique).

Example

The canonical example to demonstrate non-uniqueness for non-Lipschitz coefficients is the Tanaka equation,

with [math]X_0=0[/math], where [math]sgn(x) [/math] is the sign function; [math]sgn(x) = 1[/math] if [math]x \gt 0[/math], [math]sgn(x) = -1[/math] if [math]x \lt 0[/math] and [math]sgn(x) = 0[/math] if [math]x=0[/math]. Consider another Brownian motion [math]\hat W_t[/math] and define

where it can be checked that [math]\widetilde W_t[/math] is also a Brownian motion. We can also write

which shows that [math]X_t=\hat W_t[/math] is a solution to the Tanaka equation. However, this is referred to as a weak solution, meaning that the driving Brownian motion was recovered after the solution [math]X[/math] was given; a strong solution is a solution obtained when first the Brownian motion is given. Notice this weak solution is non-unique: take [math]Y_t=-X_t[/math] and look at the differential,

Notice that [math]X_t\equiv 0[/math] is also a solution.

Given a stochastic differential equation, Itö's lemma tells us the differential of any function on that process. Itö's lemma can be thought of as the stochastic analogue to differentiation, and is a fundamental tool in stochastic differential equations:

(Itö's Lemma). Consider the process [math]X_t[/math] with SDE [math]dX_t = a(X_t)dt+b(X_t)dW_t[/math]. For a function [math]f(t,x)[/math] with at least one derivative in [math]t[/math] and at least two derivatives in [math]x[/math], we have

Details on the Itö Lemma. The proof of \eqref{eq:itoLemma} is fairly involved and has several details to check, but ultimately, Itö's lemma is a Taylor expansion to the 2nd order term, e.g.

for [math]0 \lt t-t_0\ll 1[/math], (i.e. [math]t[/math] just slightly greater than [math]t_0[/math]). To get a sense of why higher order terms drop out, take [math]t_0=0[/math] and [math]t_n = nt/N[/math] for some large [math]N[/math], and use the Taylor expansion:

where [math]\xi_n[/math] is some (random) intermediate point to make the expansion exact. Now we use independent increments and the fact that

from which is can be seem that the [math]f'[/math] and [math]f''[/math] are are significant,

and assuming there is some bound [math]M \lt \infty[/math] such that [math]|f'''|\leq M[/math] and [math]|f''''|\leq M[/math], we see that the higher order terms are arbitrarily small,

where we've used the Cauchy-Schwartz inequality, [math]\mathbb E|Z|^3\leq \sqrt{\mathbb E|Z|^6}[/math] for some random-variable [math]Z[/math].

The following are examples that should help to familiarize with the Itö lemma and solutions to SDEs:

Example [math]dX_t = \kappa(\theta-X_t)dt+\gamma dW_t[/math] has solution

This solution uses an integrating factor[Notes 1] of [math]e^{\kappa t}[/math],

Example

Example [math]\frac{dS_t}{S_t} = \mu dt+\sigma dW_t[/math] has solution

which is always positive. Again, verify with Itö's lemma. Also try Itö's lemma on [math]\log(S_t)[/math].

Example Suppose [math]dY_t =(\sigma^2 Y_t^3 -aY_t)dt+\sigma Y_t^2dW_t[/math]. Apply Itö's lemma to [math]X_t = -1/Y_t[/math] to get a simpler SDE for [math]X_t[/math],

Notice that [math]Y_t[/math]'s SDE doesn't satisfy the criterion of Theorem, but though the change of variables we see that [math]Y_t[/math] is really a function of [math]X_t[/math] that is covered by the theorem.

Multivariate Itö Lemma

Let [math]W_t = (W_t^1,W_t^2,\dots,W_t^n)[/math] be an [math]n[/math]-dimensional Brownian motion such that [math]\frac 1t\mathbb EW_t^iW_j^j = \indicator{i=j}[/math]. Now suppose that we also have a system of SDEs, [math]X_t = (X_t^1,X_t^2,\dots,X_t^m)[/math] (with [math]m[/math] possibly not equal to [math]n[/math]) such that

where [math]\alpha_i:\mathbb R^m\rightarrow \mathbb R[/math] are the drift coefficients, and the diffusion coefficients [math]b_{ij}:\mathbb R^m\rightarrow \mathbb R[/math] are such that [math]b_{ij}=b_{ji}[/math] and

i.e. for each [math]x\in\mathbb R^m[/math] the covariance matrix is positive definite. For some differentiable function, there is a multivariate version of the Itö lemma.

(The Multivariate Itö Lemma). Let [math]f:\mathbb R^+\times\mathbb R^m\rightarrow \mathbb R[/math] with at least one derivative in the first argument and at least two derivatives in the remaining [math]m[/math] arguments. The differential of [math]f(t,X_t)[/math] is

Equation \eqref{eq:multiVarIto} is essentially a 2nd-order Taylor expansion like the univariate case of equation \eqref{eq:itoLemma}. Of course, Theorem still applies to to the system of SDEs (make sure [math]a_i[/math] and [math]b_{ij}[/math] have linear growth and are Lipschitz continuous for each [math]i[/math] and [math]j[/math]), and in the multidimensional case it is also important whether or not [math]n\geq m[/math], and if so it is important that there is some constant [math]c[/math] such that [math]\inf_x\mathbf b(x) \gt c \gt 0[/math]. If there is not such constant [math]c \gt 0[/math], then we are possibly dealing with a system that is degenerate and there could be (mathematically) technical problems.

Correlated Brownian Motion. Sometimes the multivariate case is formulated with a correlation structure among the [math]W_t^i[/math]'s, in which the Itö lemma of equation \eqref{eq:multiVarIto} will have extra correlation terms. Suppose there is correlation matrix,

where [math]\rho_{ij}=\rho_{ji}[/math] and such that [math]\frac 1t\mathbb EW_t^iW_t^j=\rho_{ij}[/math] for all [math]i,j\leq n[/math]. Then equation \eqref{eq:multiVarIto} becomes

Example

and with [math]\frac 1t\mathbb EW_t^1W_t^2 = \rho[/math]. Then,

The Feynman-Kac Formula

If you one could identify the fundamental link between asset pricing and stochastic differential equations, it would be the Feynman-Kac formula. The Feynman-Kac formula says the following:

Let the function [math]f(x)[/math] be bounded, let [math]\psi(x)[/math] be twice differentiable with compact support[Notes 2] in [math]K\subset \mathbb R[/math], and let the function [math]q(x)[/math] is bounded below for all [math]x\in\mathbb R[/math], and let [math]X_t[/math] be given by the SDE

- For [math]t\in[0,T][/math], the Feynman-Kac formula is

[[math]] \begin{equation} \label{eq:FCformula} v(t,x) = \mathbb E\left[ \int_t^Tf(X_s)e^{-\int_t^sq(X_u)du}ds+e^{-\int_t^Tq(X_s)ds}\psi(X_T)\Big|X_t=x\right] \end{equation} [[/math]]and is a solution to the following partial differential equation (PDE):[[math]] \begin{eqnarray} \label{eq:FCpde} \frac{\partial}{\partial t}v(t,x) +\left( \frac{b^2(x)}{2}\frac{\partial^2}{\partial x^2}+a(x)\frac{\partial}{\partial x}\right)v(t,x) - q(x)v(t,x)+f(t,x) &=&0\\ \label{eq:FCpdeTC} v(T,x)&=&\psi(x)\ . \end{eqnarray} [[/math]]

- If [math]\omega(t,x)[/math] is a bounded solution to equations \eqref{eq:FCpde} and \eqref{eq:FCpdeTC} for [math]x\in K[/math], then [math]\omega(t,x) = v(t,x)[/math].

The Feynman-Kac formula will be instrumental in pricing European derivatives in the coming sections. For now it is important to take note of how the SDE in \eqref{eq:FCsde} relates to the formula \eqref{eq:FCformula} and to the PDE of \eqref{eq:FCpde} and \eqref{eq:FCpdeTC}. It is also important to conceptualize how the Feynman-Kac formula might be extended to the multivariate case. In particular for scalar solutions of \eqref{eq:FCpde} and \eqref{eq:FCpdeTC} that are expectations of a multivariate process [math]X_t\in\mathbb R^m[/math], the key thing to realize is that [math]x[/math]-derivatives in \eqref{eq:FCpde} are the same is the [math]dt[/math]-terms in the Itö lemma. Hence, multivariate Feynman-kac can be deduced from the multivariate Itö lemma.

Girsanov Theorem

Another important link between asset pricing and stochastic differential equations is the Girsanov theorem, which provides a means for defining the equivalent martingale measure.

For [math]T \lt \infty[/math], consider a Brownian motion [math](W_t)_{t\leq T}[/math], and consider another process [math]\theta_t[/math] that does not anticipate future outcomes of the [math]W[/math] (i.e. given the filtration [math]\mathcal F_t^W[/math] generated by the history of [math]W[/math] up to time [math]t[/math], [math]\theta_t[/math] is adapted to [math]\mathcal F_t^W[/math]). The first feature to the Girsanov theorem is the Dolean-Dade exponent:

A sufficient condition for the application of Girsanov theorem is the Novikov condition,

Given the Novikov condition, the process [math]Z_t[/math] is a martingale on [math][0,T][/math] and a new probability measure is defined using the density

in general [math]Z[/math] may not be a true martingale but only a local martingale (see Appendix and [5]). The Girsanov Theorem is stated as follows:

(Girsanov Theorem). If [math]Z_t[/math] is a true martingale on [math][0,T][/math] then the process [math]\widetilde W_t = W_t-\int_0^t\theta_sds[/math] is Brownian motion under the measure [math]\mathbb Q[/math] on [math][0,T][/math].

Example

and let [math]r\geq 0[/math] be the risk-free rate of interest. For the exponential martingale

the process [math] W_t^Q \doteq \frac{\mu-r}{\sigma}t+W_t[/math] is [math]\mathbb Q[/math]-Brownian motion, and the price process satisfies,

Hence

and [math]S_te^{-rt}[/math] is a [math]\mathbb Q[/math]-martingale.

General references

Papanicolaou, Andrew (2015). "Introduction to Stochastic Differential Equations (SDEs) for Finance". arXiv:1504.05309 [q-fin.MF].

References

- Black, F. and Scholes, M. (1973).The pricing of options and corporate liabilities.Journal of Political Economy, 81(3):637--54.

- Merton, R. (1973).On the pricing of corporate debt: the risk structure of interest rates.Technical report.

- Björk, T. (2000).Arbitrage Theory in Continuous Time.Oxford University Press, 2nd edition.

- 4.0 4.1 {\O}ksendal, B. (2003).Stochastic differential equations: an introduction with applications.Springer.

- Harrison, M. and Pliska, S. (1981).Martingales and stochastic integrals in the theory of continuous trading.Stochastic Processes and their Applications, (3):215--260.

Notes

- For an ordinary differential equation [math]\frac{d}{dt}X_t+\kappa X_t = a_t[/math], the integrating factor is [math]e^{\kappa t}[/math] and the solution is [math]X_t = X_0e^{-\kappa t}+\int_0^ta_se^{-\kappa(t-s)}ds[/math]. An equivalent concept applies for stochastic differential equations.

- Compact support of a function means there is a compact subset [math]K[/math] such that [math]\psi(x) = 0[/math] if [math]x\notin K[/math]. For a real function of a scaler variable, this means there is a bound [math]M \lt \infty[/math] such that [math]\psi(x)=0[/math] if [math]|x| \gt M[/math].